Wisconsin Income Tax Calculator 2024. 20 24 income tax estimator. This tax is applied based on income brackets, with rates increasing for higher levels of income.

2021 2022 2023 2024 2025* select your filing status. If you make $70,000 a year living in delaware you will be taxed $11,042.

This Tax Calculation Provides An Overview Of Federal And State Tax Payments For An Individual With No.

The state income tax rate in wisconsin is progressive and ranges from 3.54% to 7.65% while federal income tax rates range from 10% to 37% depending on your income.

Calculate Your Income Tax In Wisconsin And Salary Deduction In Wisconsin To Calculate And Compare Salary After Tax For Income In Wisconsin In The 2024 Tax Year.

Calculate your annual salary after tax using the online wisconsin tax calculator, updated with the 2023 income tax rates in wisconsin.

Up To $23,200 (Was $22,000 For 2023) — 10%;.

Images References :

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Calculate your income tax, social security. If you have less than $500,000 in payroll, you’ll pay 3.05%.

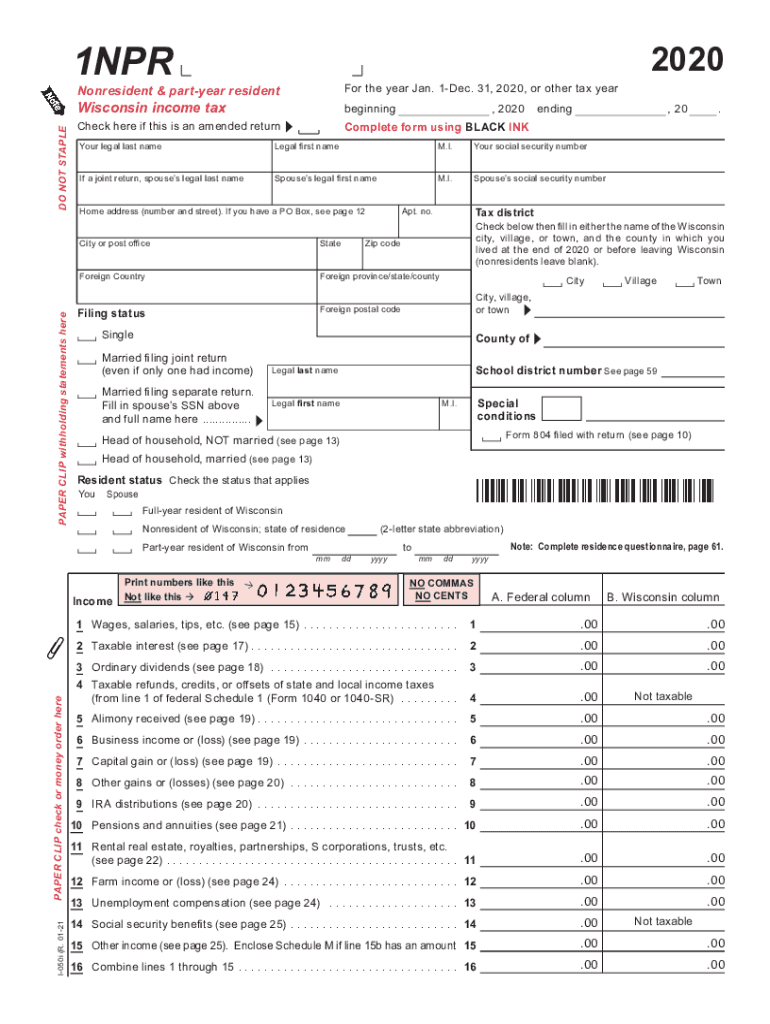

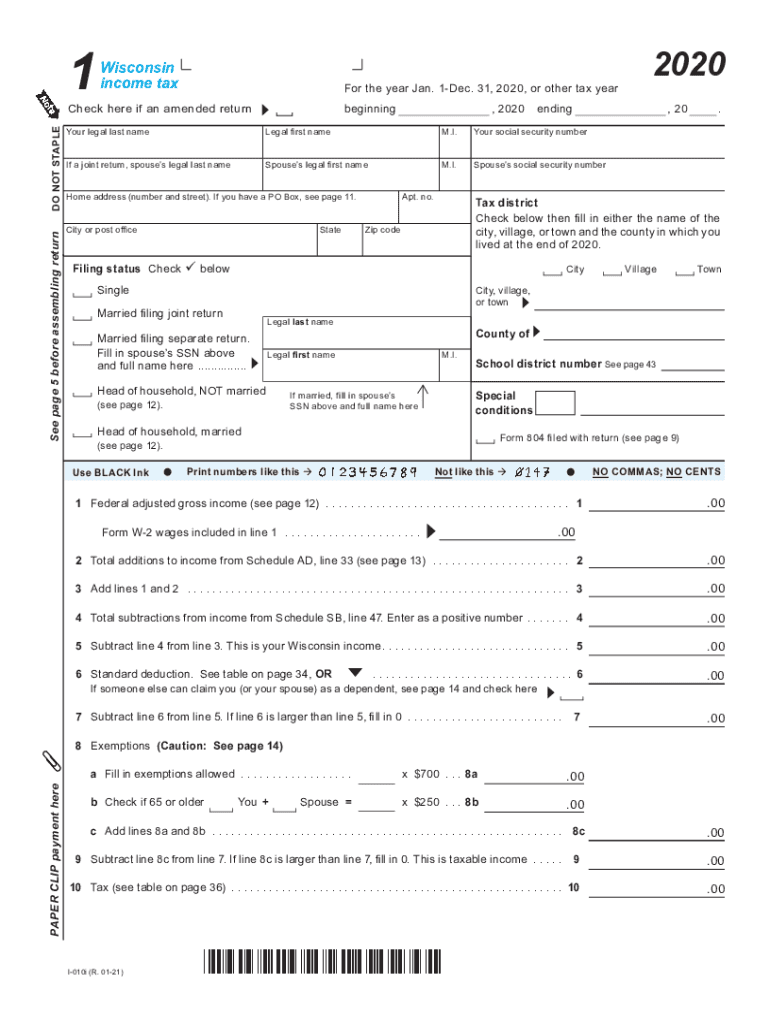

Source: www.signnow.com

Source: www.signnow.com

1npr Wi 20202024 Form Fill Out and Sign Printable PDF Template, This tool is designed for simplicity and ease of use, focusing solely on income. For married couples who file a joint tax return, the 2024 income brackets and corresponding tax rates are as follows:

Source: www.dochub.com

Source: www.dochub.com

Wisconsin schedule sb Fill out & sign online DocHub, ($18,000 for 2024) for any one beneficiary in a tax. If you have less than $500,000 in payroll, you’ll pay 3.05%.

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png) Source: floridacreativeliving.com

Source: floridacreativeliving.com

How to Fill out Form W4 in 2022 (2023), This page contains the tax table information used for the calculation of tax and payroll deductions in wisconsin in 2024. The salary tax calculator for wisconsin income tax calculations.

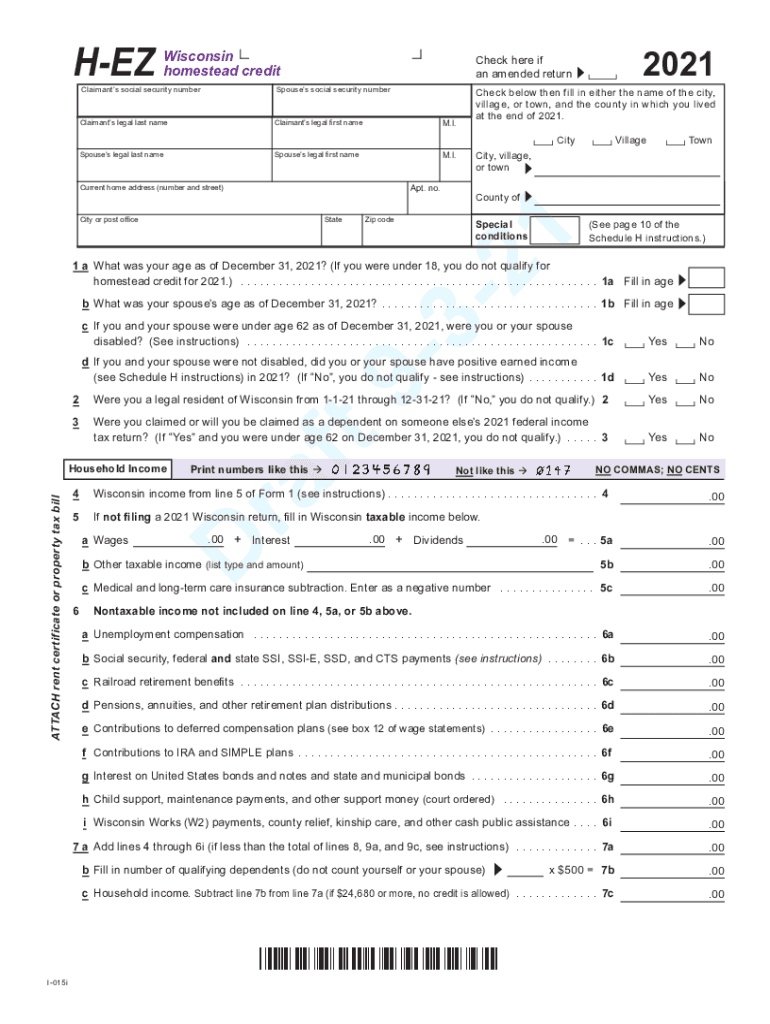

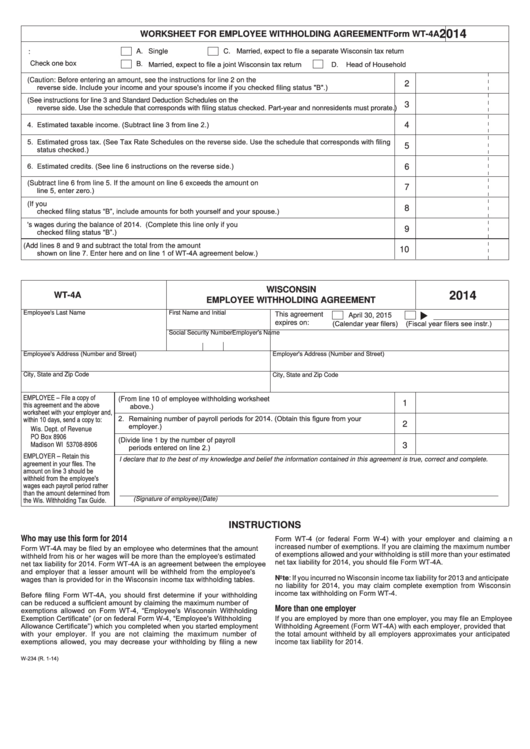

Source: www.signnow.com

Source: www.signnow.com

Wisconsin Homestead Credit 20212024 Form Fill Out and Sign Printable, The state income tax rate in wisconsin is progressive and ranges from 3.54% to 7.65% while federal income tax rates range from 10% to 37% depending on your income. You are able to use our wisconsin state tax calculator to calculate your total tax costs in the tax year 2023/24.

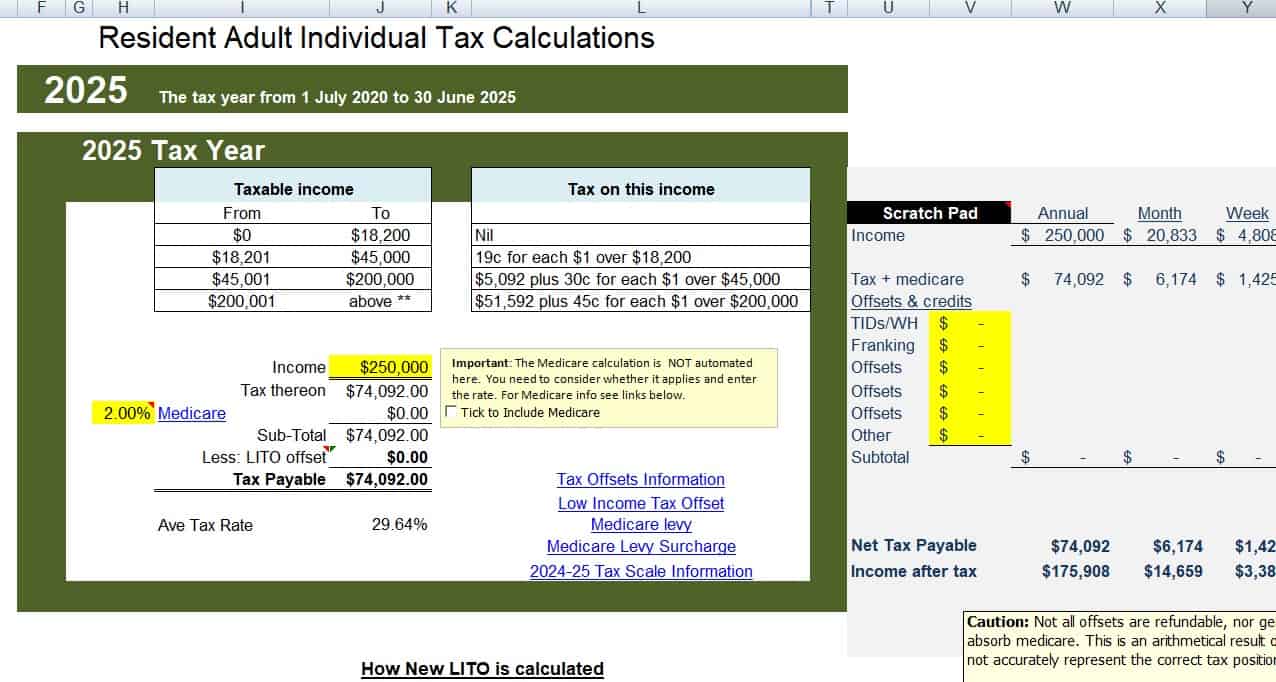

Source: atotaxrates.info

Source: atotaxrates.info

Tax Calculator atotaxrates.info, Enter your income and filing status ? Calculate your income tax in wisconsin and salary deduction in wisconsin to calculate and compare salary after tax for income in wisconsin in the 2024 tax year.

![Tax Calculator FY 202324 Excel [DOWNLOAD] FinCalC Blog](https://i.ytimg.com/vi/4MNnk4NFRuw/maxresdefault.jpg) Source: fincalc-blog.in

Source: fincalc-blog.in

Tax Calculator FY 202324 Excel [DOWNLOAD] FinCalC Blog, There is a statewide income tax in wisconsin. You are able to use our wisconsin state tax calculator to calculate your total tax costs in the tax year 2023/24.

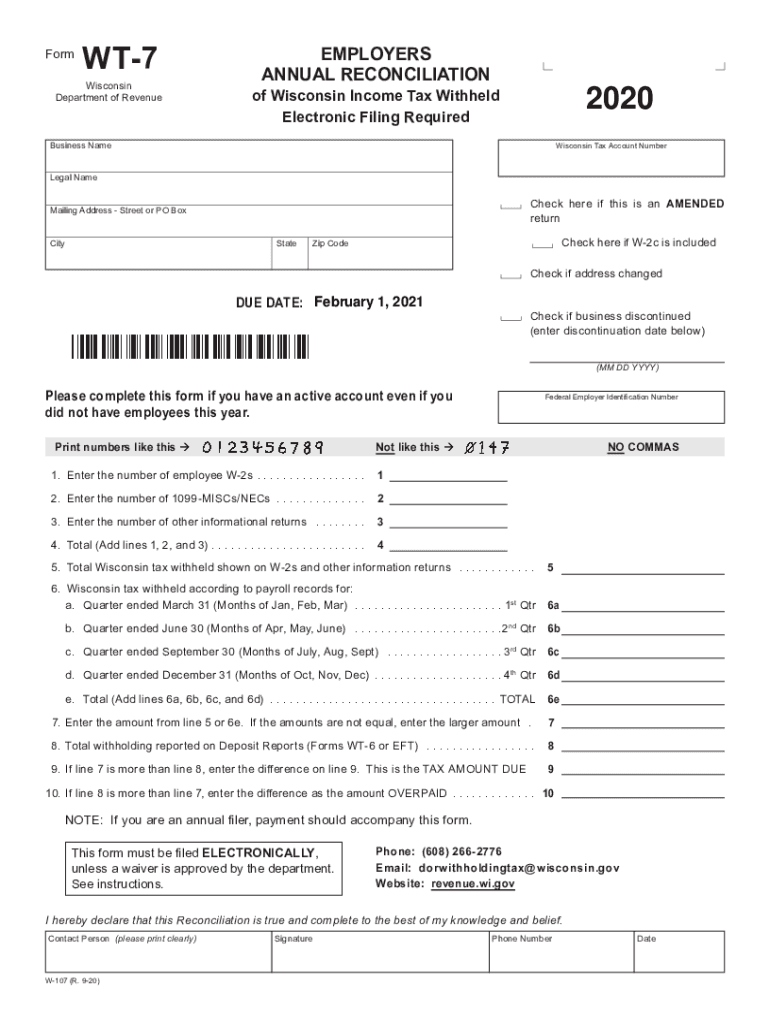

Source: www.signnow.com

Source: www.signnow.com

Wisconsin W T 20202024 Form Fill Out and Sign Printable PDF Template, If you have less than $500,000 in payroll, you’ll pay 3.05%. Single head of household married filing joint married filing.

Source: www.signnow.com

Source: www.signnow.com

Wisconsin 20202024 Form Fill Out and Sign Printable PDF, Claim exemptions and dependants ? Calculate your income tax in wisconsin and salary deduction in wisconsin to calculate and compare salary after tax for income in wisconsin in the 2024 tax year.

Source: www.employeeform.net

Source: www.employeeform.net

Wisconsin Employee Tax Withholding Form 2023, This tax is applied based on income brackets, with rates increasing for higher levels of income. Calculate your income tax in wisconsin and salary deduction in wisconsin to calculate and compare salary after tax for income in wisconsin in the 2024 tax year.

These Tax Tables Are Used For The Tax And Payroll.

Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

How To Use This Calculator.

The salary tax calculator for wisconsin income tax calculations.